This article originally appeared on our substack

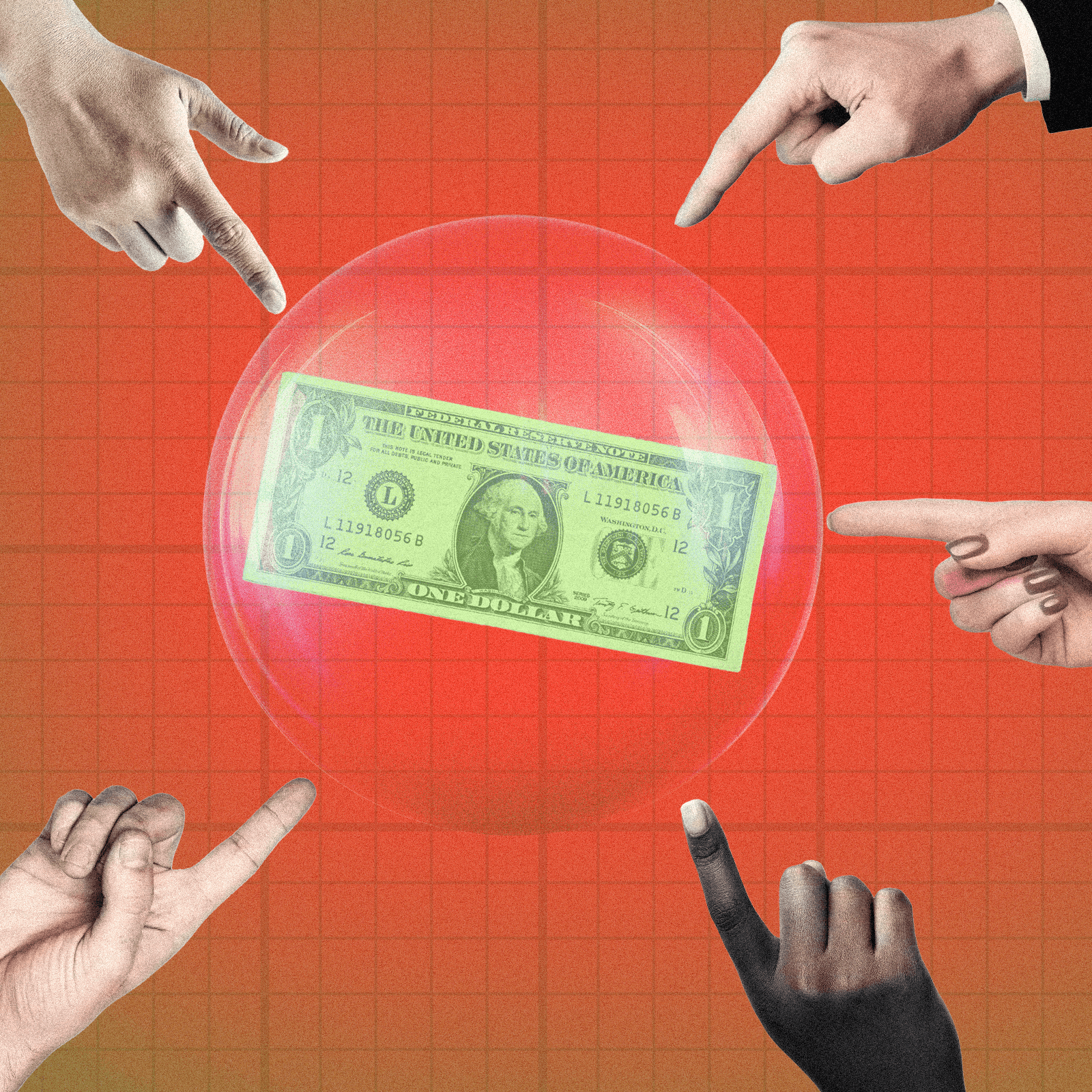

At the start of the year, we ran a story on The Lost Debate Show podcast about warning signs of a global recession. Quoting investor Jeremy Grantham, we asked whether we were in the midst of a “super bubble” – defined as a 3-sigma deviation from trend — the fourth such in 100 years.

In case it isn’t obvious, bubbles are bad and super bubbles are worse. Here’s Grantham explaining why:

As bubbles form, they give us a ludicrously distorted view of our real wealth, which encourages us to spend accordingly. Then, as bubbles break, they crush most of those dreams and accelerate the negative economic forces on the way down.

When our current super bubble bursts, warned Grantham, it’s going to be particularly devastating because it’s the first to include so many asset classes under historic overvaluation all at once: equities, housing, and commodities.

Unfortunately, it seems that Grantham may have been right. Here are five reasons to think our day of reckoning may have already arrived.

Storm Clouds from China

China is facing four major economic challenges at once: massive Covid lockdowns, planned deleveraging in key sectors (especially property), an increasingly tense relationship with its largest trading partner (the U.S.), and the growing war-related costs of its alliance with Russia.

Covid lockdowns may be the most potent of those forces, at least in the short term. Chinese authorities are currently enforcing full or partial lockdowns in at least 27 cities, affecting up to 180 million people. This lockdown is not only a drag on the well-being of their population and a looming humanitarian crisis (only half of Chinese aged 80 and older are fully vaccinated against Covid), but it’s also threatening the global economy. China alone could keep inflation high at a time many thought it would start to wane. It’s true that China’s struggles could have some deflationary effects, as its weaker domestic demand means it consumes less oil and other imported goods and commodities. But given they are a net exporter, that deflationary effect could be dwarfed by the coming scarcity and increased cost of goods the country manufactures and ships abroad.

The lockdowns are only part of the story. A May 1st Wall Street Journal article painted a bleak picture of almost every sector of the Chinese economy. Here are just a few of the details from that story:

- “On Saturday, purchasing manager indexes released by China’s government showed contractions in factory and service-sector activity for a second straight month in April. They fell to their lowest levels since the pandemic began in 2020.”

- “Cement production in mid-April was less than 40% of full capacity. Shipments of smartphones dropped 18% from a year earlier in the first quarter. Excavator sales within China were down 61% in April compared with the previous year.”

- “Surveyed unemployment in China’s 31 largest cities has surpassed the level it hit when Wuhan was locked down in 2020. Youth unemployment is now 16%, according to official data.”

- “More than 10 million college students are due to graduate this year, a record for China, but a gauge of vacancies compiled by the China Institute for Employment Research at Renmin University of China and job search website Zhaopin suggests there aren’t nearly enough jobs for them all.”

- “About a third of China’s 290 million migrant laborers haven’t returned to their cities of employment since the Lunar New Year in February amid the Covid restrictions. The number of people employed at small- and medium-size businesses has shrunk by around 30%, according to research firm J Capital Research, based on interviews with Chinese labor agencies.”

An incompetent (at least as it relates to Covid management) authoritarian government with a colossal and growing population of young and migrant laborers out of work? That sounds like a recipe for civil unrest, which could only serve to further deepen China’s economic struggles.

It’s worth remembering that China in many ways led the recovery from the 2008 financial crisis, but there’s little reason to believe they will do so this time. A prior IMF projection had China accounting for a quarter of global economic growth in the five years through 2026, but their latest forecast would have China on pace for its worst year for growth since 1990 (aside from 2020).

The collateral damage from China’s struggles is already doing damage to its neighbors, who are seeing exports to the country drop as prices for key goods increase.

Big Trouble in Big Tech

The technology sector is facing one of its most turbulent stretches in years. Recent lackluster earnings reports have sent stock prices of major growth companies like Lyft and Uber plunging. Shares of Amazon, Meta, and Netflix are all down 30% this year (as of Sunday) — more than double the 13% drop in the S&P.

These losses were driven by real concerns over the fundamentals of these companies. In April, Amazon reported its slowest quarterly revenue growth in almost two decades. Warehouses were overstaffed and underutilized, all while operating expenses have grown faster than sales revenue. Netflix lost subscribers for the first time in over a decade, leading to a $54 billion hit to its market cap in a single day. Meta has announced a hiring freeze for mid- to senior-level positions just months after announcing it would make a hiring push to invest more staffing in their Metaverse work.

This is a huge risk to the system, because of these companies’ unprecedented share of the market. Here’s Lu Wang, Vildana Hajric, and Isabelle Lee in Bloomberg:

The five tech giants, Meta Platforms Inc., Apple Inc., Amazon.com Inc., Microsoft Corp. and Alphabet Inc., at one point accounted for a quarter of the S&P 500, boasting an influence that’s greater than any comparable group of stocks since at least 1980. Now that the group, known as the Faangs, has seen their total value shaved by 23% from the December peak, a drag that the market has no chance of shaking off. The S&P 500 is mired in its second-longest correction since the global financial crisis.

What’s driving this retrenchment? Each of these companies has a host of unique challenges and opportunities. For example, the return to normal would seem to hurt Netflix (as people are spending less time in front of their TVs) but should be helping Uber and Lyft. But there are certain headwinds that are common to most of these companies.

The first culprit is inflation, which has not only decimated consumer spending power but is also driving up prices for workers, a problem that seems particularly stark for Amazon, who employs an army of drivers and warehouse workers. Then there are rising interest rates, which are drying up the flood of capital seeking outsized returns in the tech sector. And the aforementioned lockdowns in China are ensnaring supply chains and driving up costs for all manner of goods. Apple has said that the Covid surge in China could hinder sales by up to $8 billion this quarter.

In short, Big Tech could be the equivalent to housing in 2008 — the anchor to our economy’s Lusitania.

Nowhere to Put Your Money

Stocks Thursday saw their largest single-day decline since the start of the pandemic — continuing a five-week decline in the S&P 500 and an overall bleak year for equities. These losses are spreading from speculative stocks to reliable blue chip companies. Bitcoin also dropped below $35,000 over the weekend, down over $10,000 from the start of the year.

What’s going on here? The easiest explanation is that rising interest rates make the stock market — especially the most speculative equities — less attractive. But that doesn’t explain why stocks dipped after Chairman Powell signaled he would be unlikely to raise interest rates by more than a half a point at a time. It’s hard to tell what’s driving this decline, and it’s likely a combination of forces. Investors may be deleveraging — unwinding trades conducted on margin. Some funds may also be liquidating after some big bets gone wrong. And, of course, this could just be animal spirits. The story we’re being told is that we’re heading for recession, and sometimes the story is enough to guarantee we’ll get there.

Labor Continues to Get More Expensive

Many economists have been predicting we should see inflation wane right about now. They could be right, but there’s worrying signs that cost categories will continue to rise. I’ve already discussed China and supply chains, but this problem isn’t specific to the price of hard goods. The Wall Street Journal reported over the weekend that major hospital corporations like HCA and Universal Health Services are seeking to raise prices for services by as much as 15% in response to increased salaries due to nursing shortages. These hospital corporations account for a huge portion of overall healthcare costs, accounting for $1 trillion a year in spending.

Rising labor costs aren’t specific to healthcare, of course. And even the good news here is bad news. April brought a twelfth straight month of job gains above 400,000, and the unemployment rate remains at 3.6%, essentially where it was before the pandemic began. That’s great, but with it comes an employee base that will be demanding higher wages, driving up the costs of services across most sectors.

Many Energy Crises on the Horizon

Energy markets appear volatile in every corner of the globe. Indian power plants are running out of coal, as two-thirds of households are facing regular power cuts. In the United States, grid operators are warning that power-generating capacity is trailing demand, and predict rolling blackouts this summer from California to Indiana to Texas. The main culprit is an aging grid combined with the fact that traditional power plants are being retired faster than renewables and other replacements become operational. Then there’s the ongoing war in Ukraine which has injected uncertainty into the energy markets, most recently with the G-7 pledging to phase out Russian oil imports.

All of these trends point to another possible global spike in energy prices, which would lead to a further rise in the cost of goods and services.

The bottom line: it’s past time to batten down the hatches, board up the windows, and lock up the stables. There’s a storm coming, and it may already be here.